New research has revealed that an estimated 12 million UK consumers will turn to short term credit instalment plans this Christmas to afford presents and other essential items.

The research, which follows a survey of more than 1,000 consumers across the United Kingdom, finds that nearly half (43%) are concerned about making ends meet during the festive season.

Following months of cost of living worries exacerbated by high inflation which has seen over two-thirds (68%) of consumers change their day-to-day financial habits to cut spending, UK households are turning to short term credit options, such as Buy Now, Pay Later (BNPL) to increase payment flexibility and help manage their budgets.

The research by Marqeta, the global modern card issuing platform, shows that 47% of consumers have already used BNPL due to its attractive zero interest rates, with 42% doing so because of the flexibility it provides, and a further 45% stating that it helped them with budgeting.

Access to short term credit is increasingly important to shoppers as financial pressure mounts this Christmas, with 43% of respondents reporting that their spending usually increases during the holiday season compared to months prior. As a result, consumers are looking to spread the cost of the festive period, with 39% reporting that they would be using credit, such as BNPL solutions, to help make ends meet this holiday season.

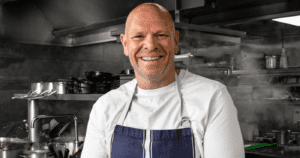

“We are seeing a fundamental shift in how people approach their finances,” says Todd Pollak, Marqeta CRO. “Short term credit innovation is offering an increasingly feasible lifeline to consumers navigating the Christmas period. With accessible options now readily available, people are keen to have more control over their yearly budget, and the flexibility to buy Christmas now, ensuring they can still make ends meet, and pay later, in months following the holiday season where there is less financial pressure.”

Read more:

New research finds an estimated 12M Brits to buy Christmas now, pay later

New research finds an estimated 12M Brits to buy Christmas now, pay la …