Could Nigel Farage really be the next UK Prime Minister? It’s a question that, a mere five years ago, would have sounded rather like asking if we’d ever see Piers Morgan run the Ministry of Manners.

And yet here we are, with Farage’s Reform UK party reportedly garnering a surge in new members—apparently outrunning the Conservatives in the membership stakes, and boasting a younger, more dynamic support base by a margin of at least 15 years. The Tory old guard, presumably, is drinking yet another cup of lukewarm tea in some draughty community hall, while the new kids on the block queue up for kombucha shots at a Reform UK rally. “The times,” as Bob Dylan assured us decades ago, “they are a-changin’.”

Of course, if we’re to believe the rumours, Reform UK also has potential financial backing from the world’s richest man himself, Elon Musk. Yes, that Elon Musk: the rocket-launching, Twitter-purchasing, multi-billionaire entrepreneur who chucks Teslas and satellites into space for sport. The same man who started off revolutionising the electric car industry and wound up with a curious hankering to buy up social media platforms for fun. Musk, mind you, is not exactly known for his shy and retiring approach to politics—or anything else. The notion that Musk might see in Farage a kindred spirit for disruptive politicking and a global platform for their shared brand of contrarian mischief is not entirely outlandish. After all, you could argue they’re both showmen of sorts, each boasting that brash, unstoppable self-confidence that could whip up a global storm in a teacup faster than you can say “Brexit 2.0.”

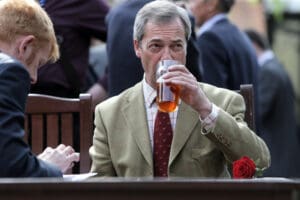

The truly staggering thing in this scenario, though, is that ordinary Britons—battle-scarred after years of Brexit sagas, pandemic bungles, and fractious leadership contests—might actually be prepared to back Farage as he once again sets out his stall. Remember, this is the man who promised to “get Brexit done” before it was even Johnson’s catchphrase, and whose dogged efforts have, arguably, shaped the entire political trajectory of the UK in the last decade. Love him or loathe him, there’s no doubt that Farage has altered the national conversation—and the national identity. He’s the unstoppable political cameo who marches in and out of the limelight, brandishing a pint and a seemingly endless array of soundbites that enrage one half of the population and endear him to the other half.

But this notion of him returning, phoenix-like, from the ashes of UKIP and Brexit Party stints, and taking on the top job at Number 10? It’s a fantasy that might have some Tory MPs waking in a cold sweat. Picture the scene: you’ve slogged your way through years of Conservative membership, handing out leaflets in the rain, only to have Nigel Farage waft in, grinning ear to ear, flanked by Elon Musk’s retinue of robotic dog prototypes, Twitter flame wars, and rocket tattoos. The possibility that the Conservatives—traditional stalwarts of British politics—could be overtaken by a party that’s not only younger but possibly richer (once Musk opens his digital chequebook) is enough to send a shiver up even the sternest suiting of the Westminster corridors.

Critics, of course, will rightly query whether Farage is even electable in the mainstream sense. Sure, he’s a household name. But is he a household name in the manner that conjures confidence and trust, or is he just that bloke who reminds you of last orders at the local pub? And how far can a brash, anti-establishment figure go in actually leading a government, rather than merely pointing fingers from the outside? We must remember that part of Farage’s whole schtick is his ability to lob grenades from the sidelines, stirring the pot and gleefully undermining whichever politician gets in his crosshairs. It’s a world away from navigating the unglamorous labyrinths of public policy, health crises, and foreign diplomacy.

Then again, one might have said the same about Donald Trump before 2016—and look how that turned out. The populist wave that swept through the Western world in the mid-2010s has quietened somewhat, but it hasn’t vanished. There are plenty of people—especially younger voters—feeling deeply disillusioned with the status quo. The Conservatives, it seems, are left trying to convince potential new supporters that “fiscally prudent” doesn’t have to mean “grey and dull.” Meanwhile, Labour does its best to claim the progressive mantle, but the ghost of Corbyn still rattles around for some, while the shadow of Blair’s New Labour is hardly the trendiest look for Gen Z. If Farage and Reform UK manage to capture a blend of rebellious energy, economic promise, and a dash of Musk’s futuristic bravado, we might be in for quite the ride.

What’s truly fascinating is how Brexit has, in many ways, reshaped British politics to allow for a figure like Farage to keep bouncing back. It used to be that once a politician declared themselves done, that was it: the diaries were published, the after-dinner circuit was booked, and the shadow of retirement loomed. Farage, on the other hand, seems blessed with an indefatigable thirst for the spotlight, always returning with a new banner, a new set of pledges, and a new reason to exclaim how dreadfully incompetent everyone else is. A cynic might say we’ve been here before, and it’s just another of Nigel’s vanity projects. But if the rumours of that Musk money are true, well, that’s the sort of budget that can shift the electoral dial in ways rarely seen in our green and pleasant land.

Could Nigel Farage really be the next UK Prime Minister? Stranger things have happened, though probably not many of them in the staid, centuries-old tapestry of British politics. For now, we can do nothing but watch with horrified fascination as the Reform UK membership balloons (if their claims are to be believed), sipping on that proverbial pint alongside Nigel—though presumably, in Musk’s presence, it might be a zero-G pint served aboard a SpaceX capsule. Meanwhile, the Conservatives look like they’re stuck in a game of musical chairs, with half their seats wobbling precariously, uncertain who’ll be left standing when the music stops.

So yes, it could happen—just don’t place your entire life savings on it yet. We Brits have learned not to discount anything in politics, especially where Mr Farage is concerned. If he does somehow assume the mantle at Number 10, one can only imagine the flamboyant cabinet picks and the possible prime ministerial statements via tweet (or X, or whatever Elon calls it by then). It might be outlandish, it might be catastrophic, but no one can deny it would be entertaining. And, if nothing else, it would confirm what many have long suspected: that in modern British politics, absolutely anything goes.

Read more:

Could Nigel Farage really be the UK’s next Prime Minister, I mean really?